How to Earn Passive Income from Home

Introduction

In today’s fast-paced world, earning passive income has become a popular financial goal for many individuals in India.

Whether you’re a student, a working professional, or a homemaker, having an additional income stream can help you achieve financial freedom and reduce your dependence on a single source of earnings.

The digital revolution has opened up countless opportunities to generate passive income from the comfort of your home.

In this comprehensive guide, we will explore various proven ways to earn passive income in India, along with actionable tips and insights to get you started.

Why Passive Income Matters

Passive income provides financial stability and offers several advantages, including:

- Financial Freedom: You are no longer solely reliant on your primary job for income.

- Time Flexibility: Passive income allows you to earn money even when you’re not actively working.

- Security Against Uncertainties: Having multiple income streams provides a safety net during economic downturns or job losses.

Now, let’s dive into some of the best ways to earn passive income from home in India.

1. Start a Blog or YouTube Channel

In today’s digital age, starting a blog or a YouTube channel can be an exciting venture that allows you to share your passions, connect with like-minded individuals, and even generate income.

This document will guide you through the essential steps to kickstart your journey in the blogging or vlogging world, helping you to establish a platform that resonates with your audience and reflects your unique voice.

Choosing Your Niche

The first step in starting a blog or YouTube channel is to identify your niche. Consider what topics you are passionate about and what you can consistently create content around.

Whether it’s cooking, travel, technology, fashion, or personal development, your niche should align with your interests and expertise. Research existing content in your chosen area to find gaps that you can fill with your unique perspective.

Setting Up Your Platform

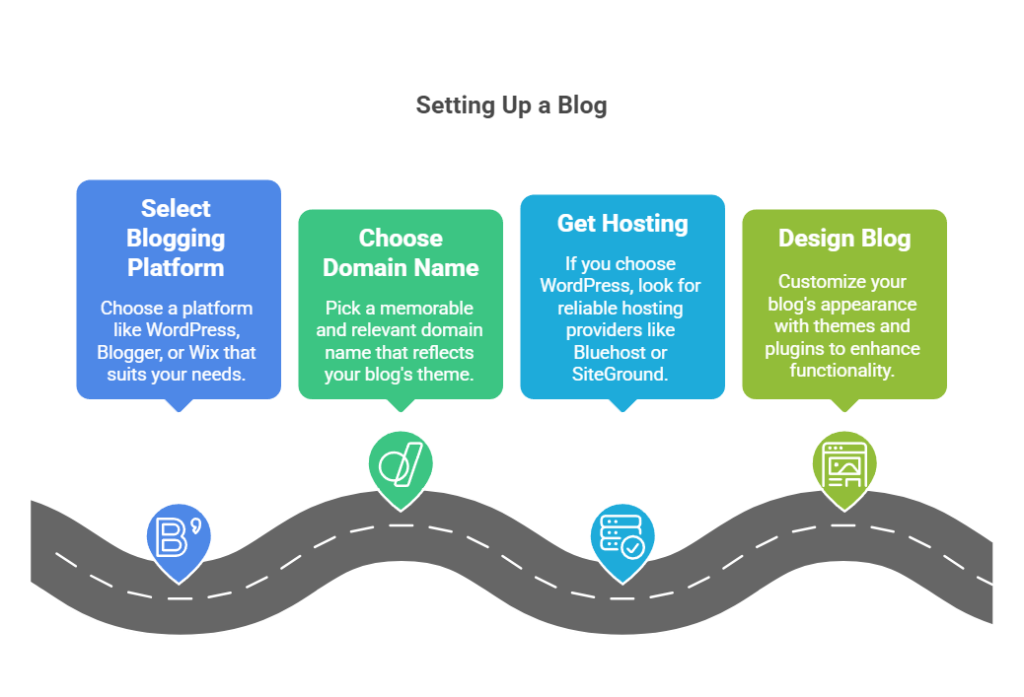

For Blogging

- Select a Blogging Platform: Choose a platform like WordPress, Blogger, or Wix that suits your needs. WordPress is highly recommended for its flexibility and customization options.

- Choose a Domain Name: Pick a memorable and relevant domain name that reflects your blog’s theme. Ensure it’s easy to spell and pronounce.

- Get Hosting: If you choose WordPress, you’ll need a hosting service. Look for reliable providers like Bluehost or SiteGround.

- Design Your Blog: Customize your blog’s appearance with themes and plugins to enhance functionality and user experience.

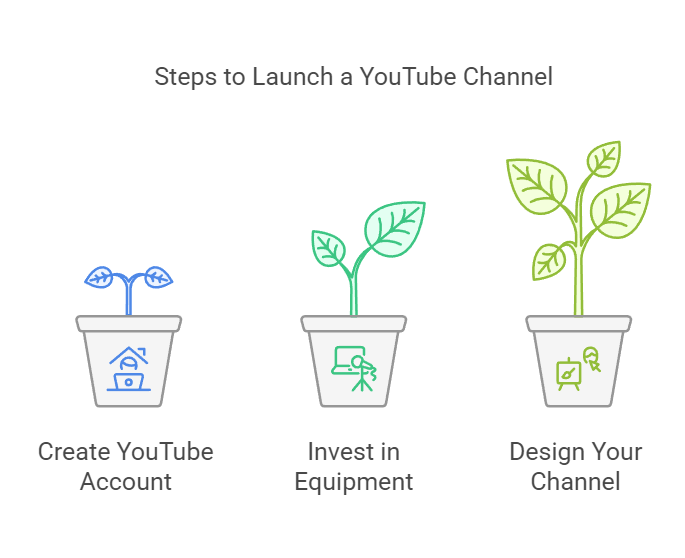

For YouTube

- Create a YouTube Account: Sign up for a YouTube account and create a channel. Choose a channel name that aligns with your content.

- Invest in Equipment: While you can start with a smartphone, consider investing in a good camera, microphone, and lighting for better video quality.

- Design Your Channel: Create an appealing channel banner and logo. Consistent branding helps in building recognition.

Content Creation

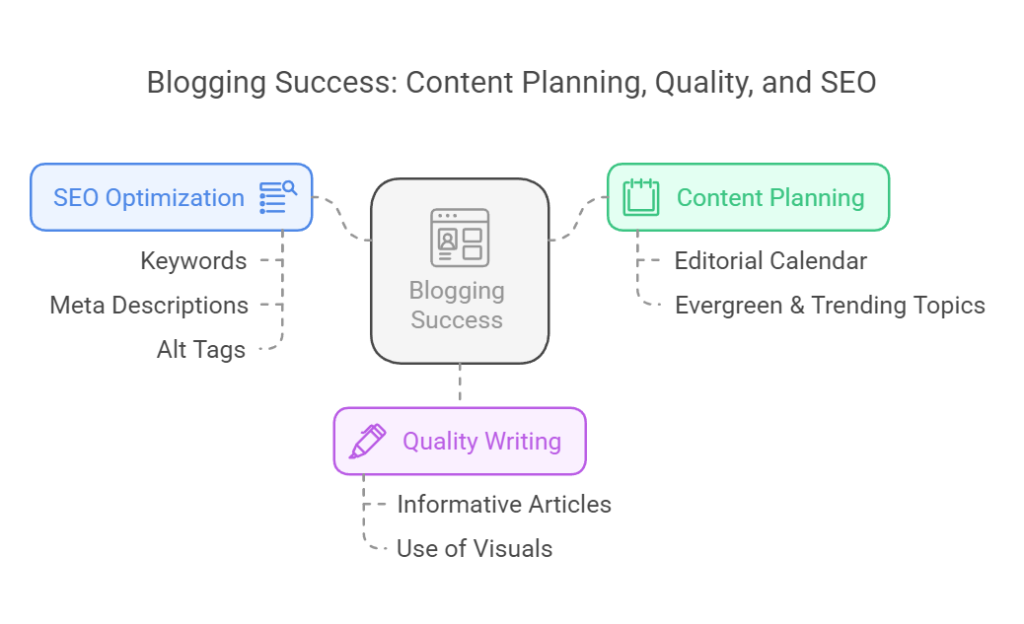

For Blogging

- Plan Your Content: Create an editorial calendar to schedule your posts. Aim for a mix of evergreen content and trending topics.

- Write Quality Posts: Focus on creating informative, engaging, and well-researched articles. Use visuals to enhance your posts.

- SEO Optimization: Learn the basics of SEO to improve your blog’s visibility on search engines. Use keywords, meta descriptions, and alt tags effectively.

For YouTube

- Script Your Videos: Outline your video content to stay on track. Practice your delivery to sound natural and engaging.

- Editing: Use editing software like Adobe Premiere Pro or Final Cut Pro to polish your videos. Add music, graphics, and transitions to enhance viewer experience.

- Thumbnails and Titles: Create eye-catching thumbnails and compelling titles to attract viewers.

Building an Audience

- Promote Your Content: Share your blog posts or videos on social media platforms like Instagram, Twitter, and Facebook. Engage with your audience to build a community.

- Collaborate: Partner with other bloggers or YouTubers in your niche to reach a wider audience.

- Consistency is Key: Regularly update your blog or upload videos to keep your audience engaged and coming back for more.

Monetization Strategies

Once you have established a following, consider monetizing your blog or YouTube channel through various methods:

- Affiliate Marketing: Promote products and earn a commission for each sale made through your referral link.

- Sponsored Content: Collaborate with brands for sponsored posts or videos.

- Ad Revenue: Enable ads on your blog or YouTube channel to earn money based on views and clicks.

- Merchandising: Create and sell your own products or merchandise related to your content.

2. Invest in Stocks and Mutual Funds

Investing in stocks and mutual funds is a powerful way to grow your wealth over time. This document explores the fundamentals of these investment vehicles, their benefits, and considerations to keep in mind when deciding where to allocate your resources.

Whether you are a beginner or looking to refine your investment strategy, understanding these options can help you make informed decisions that align with your financial goals.

Understanding Stocks

What are Stocks?

Stocks represent ownership in a company. When you purchase a stock, you buy a small piece of that company, which entitles you to a share of its profits and assets.

Stocks are traded on exchanges, and their prices fluctuate based on market conditions, company performance, and investor sentiment.

Benefits of Investing in Stocks

- Potential for High Returns: Historically, stocks have outperformed other asset classes over the long term.

- Liquidity: Stocks can be easily bought and sold on the stock market, providing flexibility to investors.

- Ownership and Voting Rights: As a shareholder, you may have a say in company decisions through voting rights.

Risks of Investing in Stocks

- Market Volatility: Stock prices can be highly volatile, leading to potential losses.

- Company-Specific Risks: Poor performance by a company can negatively impact its stock price.

- Requires Research: Successful stock investing often requires thorough research and analysis.

Understanding Mutual Funds

What are Mutual Funds?

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors.

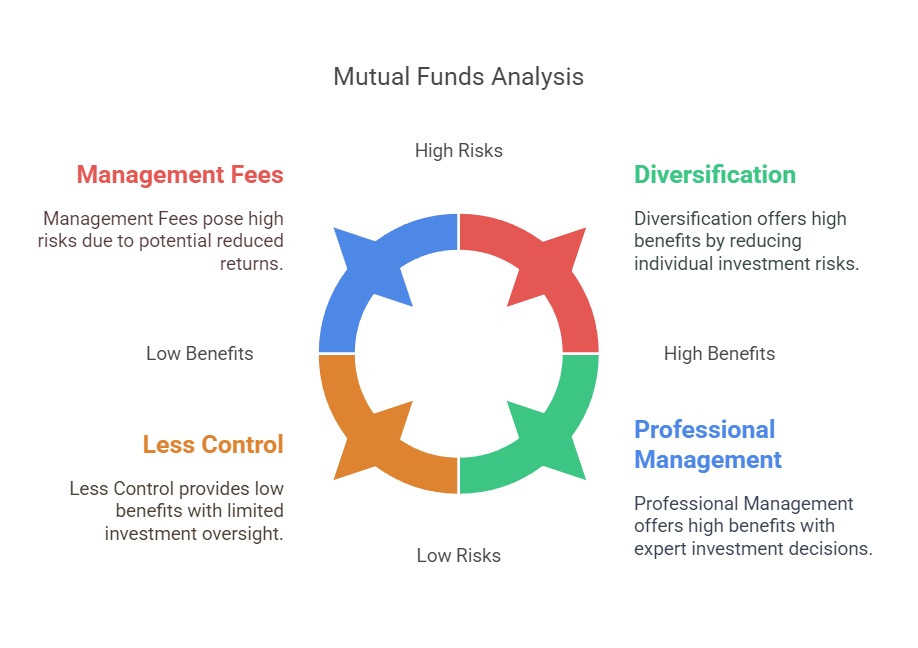

Benefits of Investing in Mutual Funds

- Diversification: Mutual funds provide instant diversification, reducing the risk associated with investing in individual stocks.

- Professional Management: Fund managers have expertise in selecting investments, which can be beneficial for those who lack time or knowledge.

- Accessibility: Many mutual funds have low minimum investment requirements, making them accessible to a wide range of investors.

Risks of Investing in Mutual Funds

- Management Fees: Mutual funds charge fees that can eat into your returns over time.

- Less Control: Investors have limited control over the specific investments within the fund.

- Market Risk: Like stocks, mutual funds are subject to market fluctuations.

Making the Right Choice

Stocks vs. Mutual Funds

When deciding between stocks and mutual funds, consider your investment goals, risk tolerance, and time horizon.

If you prefer hands-on management and are willing to take on more risk for potentially higher returns, stocks may be suitable.

Conversely, if you seek diversification and professional management with a more passive approach, mutual funds might be the better option.

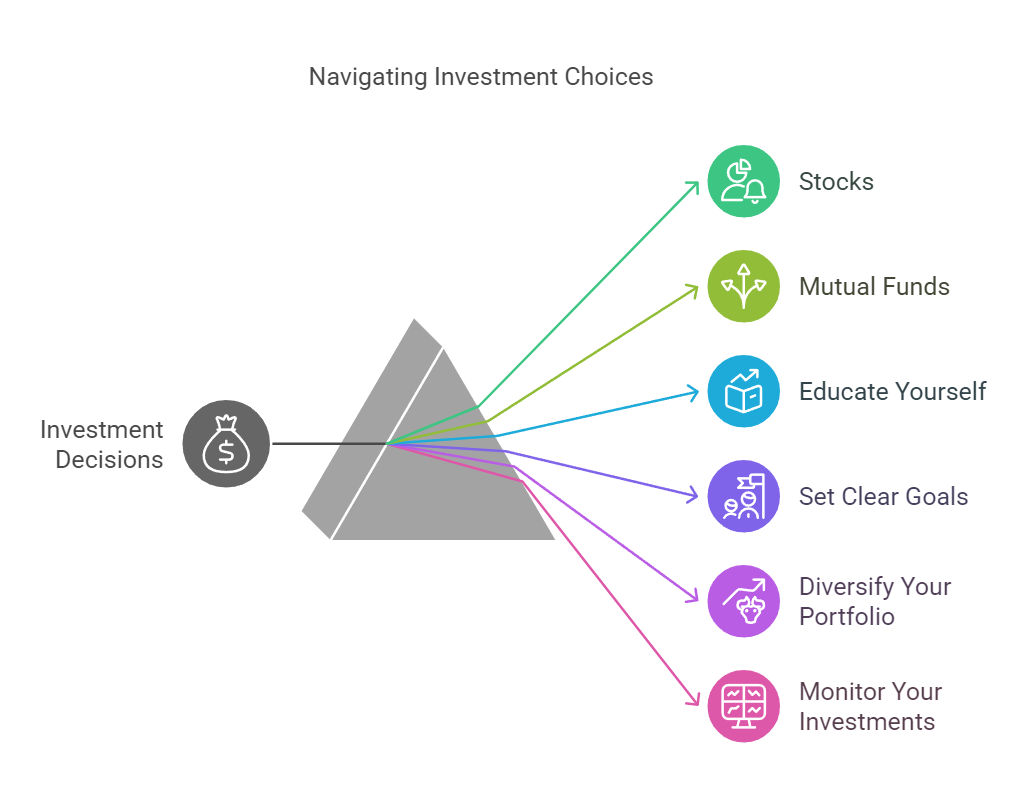

Tips for Investing

- Educate Yourself: Understand the basics of investing and stay informed about market trends.

- Set Clear Goals: Define your financial objectives and time frame for investing.

- Diversify Your Portfolio: Consider a mix of stocks and mutual funds to balance risk and return.

- Monitor Your Investments: Regularly review your portfolio and make adjustments as needed.

3. Real Estate Investments

Real estate investments have long been considered a reliable avenue for wealth accumulation and financial security.

This document explores the various facets of real estate investing, including types of investments, strategies for success, potential risks, and the benefits that come with property ownership.

Whether you are a seasoned investor or a newcomer to the field, understanding these elements is crucial for making informed decisions in the real estate market.

Types of Real Estate Investments

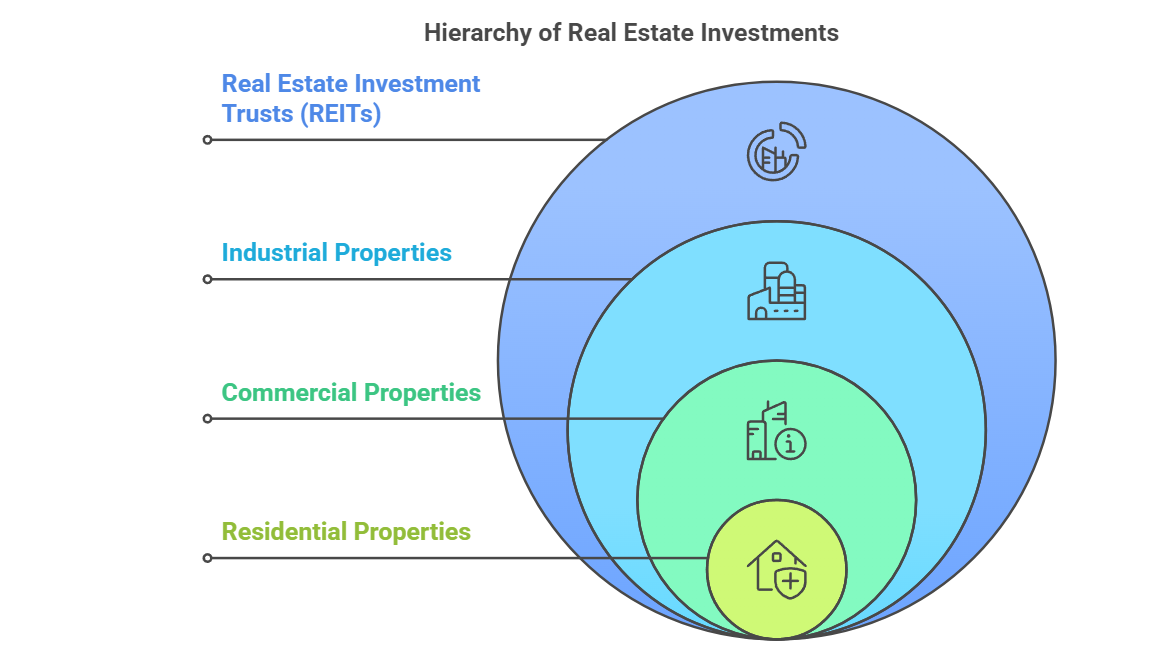

- Residential Properties: These include single-family homes, multi-family units, and condominiums. Investors can generate income through rental payments or by flipping properties for a profit.

- Commercial Properties: This category encompasses office buildings, retail spaces, and warehouses. Commercial real estate often requires a larger investment but can yield higher returns.

- Industrial Properties: These are properties used for manufacturing, production, and distribution. Investing in industrial real estate can be lucrative due to the demand for logistics and supply chain facilities.

- Real Estate Investment Trusts (REITs): REITs allow individuals to invest in real estate without having to buy properties directly. They are companies that own, operate, or finance income-producing real estate and offer shares to investors.

- Raw Land: Purchasing undeveloped land can be a speculative investment. Investors may hold onto the land until its value appreciates or develop it for residential or commercial use.

Strategies for Success

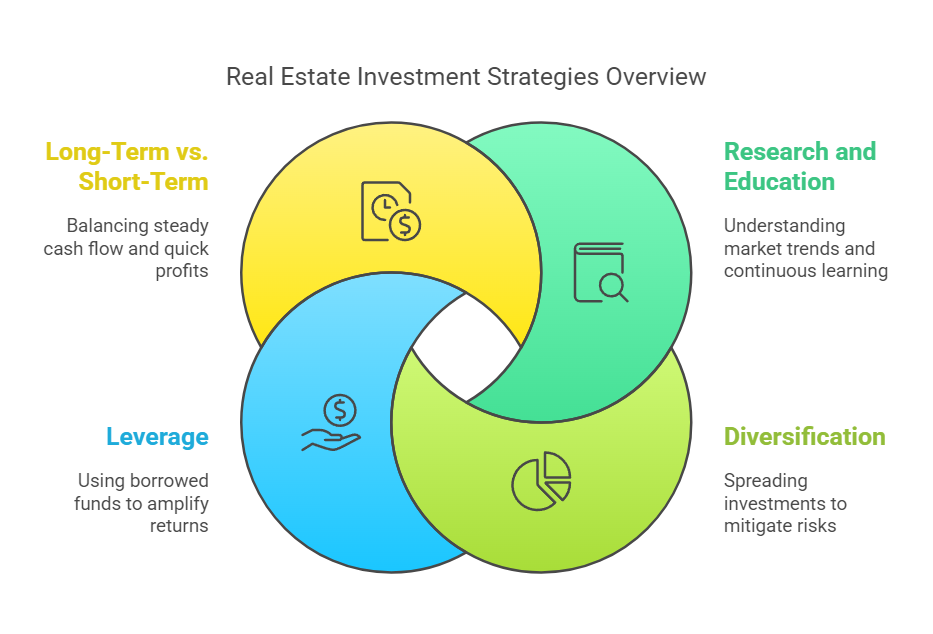

- Research and Education: Understanding the market, property values, and local trends is essential. Continuous education through courses, seminars, and networking can enhance your investment acumen.

- Diversification: Spreading investments across different types of properties can mitigate risks. A diversified portfolio can provide stability during market fluctuations.

- Leverage: Using borrowed funds to finance property purchases can amplify returns. However, it is crucial to manage debt wisely to avoid financial strain.

- Long-Term vs. Short-Term: Determine your investment horizon. Long-term investments typically provide steady cash flow, while short-term strategies like flipping can yield quick profits.

Potential Risks

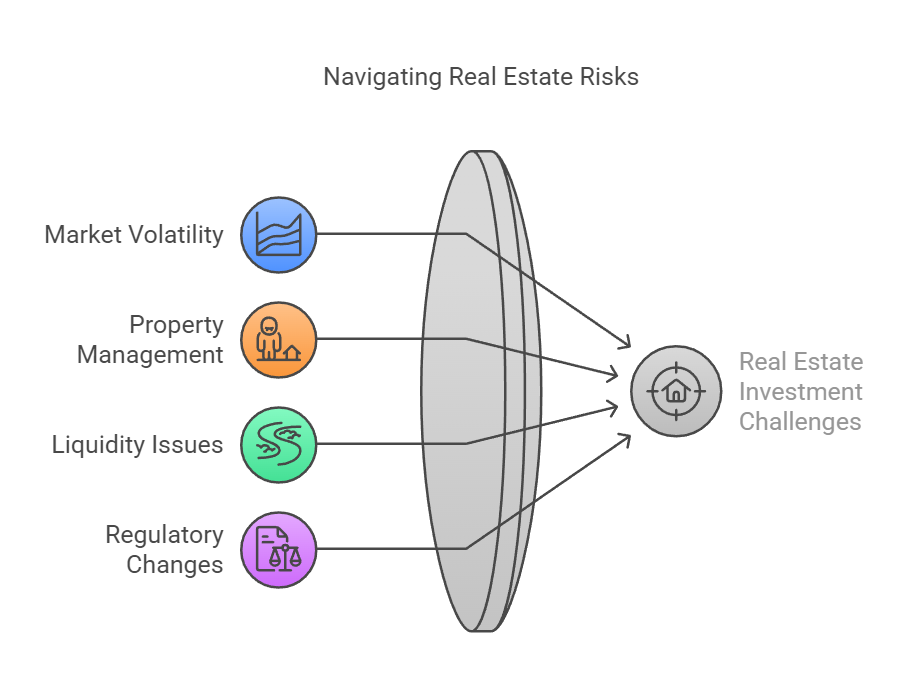

- Market Volatility: Real estate markets can be unpredictable, influenced by economic conditions, interest rates, and local demand.

- Property Management: Owning rental properties requires ongoing management, which can be time-consuming and costly if not handled properly.

- Liquidity Issues: Real estate is not as liquid as stocks or bonds. Selling a property can take time, and you may not always achieve your desired sale price.

- Regulatory Changes: Changes in zoning laws, property taxes, and rental regulations can impact the profitability of real estate investments.

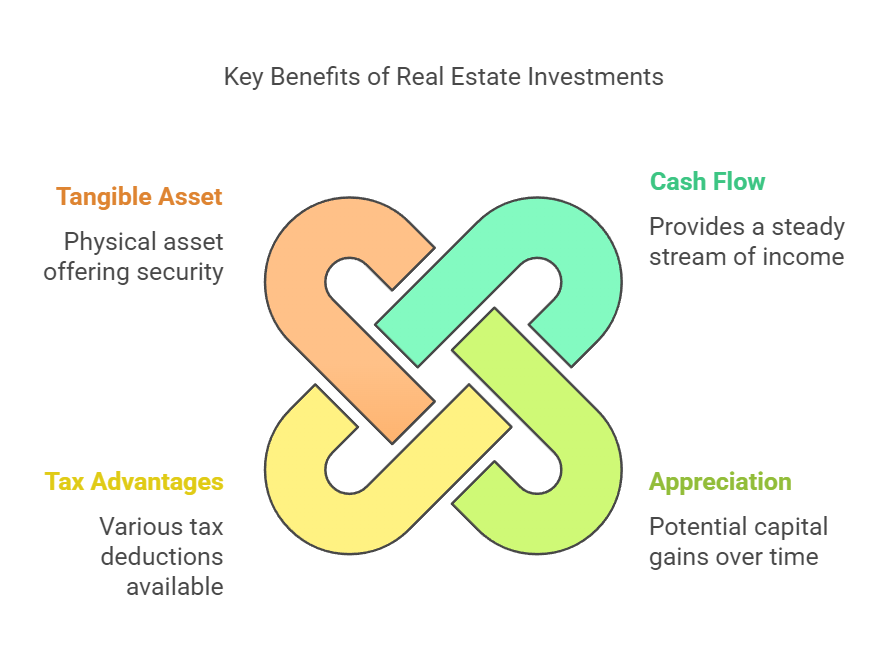

Benefits of Real Estate Investments

- Cash Flow: Rental properties can provide a steady stream of income, contributing to financial stability.

- Appreciation: Over time, real estate values tend to increase, offering potential capital gains upon sale.

- Tax Advantages: Real estate investors can benefit from various tax deductions, including mortgage interest, property depreciation, and operating expenses.

- Tangible Asset: Unlike stocks or bonds, real estate is a physical asset that can provide a sense of security and stability.

4. Affiliate Marketing

Affiliate marketing is a performance-based marketing strategy where businesses reward affiliates for driving traffic or sales to their products or services through the affiliate’s marketing efforts.

This document explores the fundamentals of affiliate marketing, its benefits, strategies for success, and tips for both affiliates and merchants to maximize their potential in this dynamic field.

What is Affiliate Marketing?

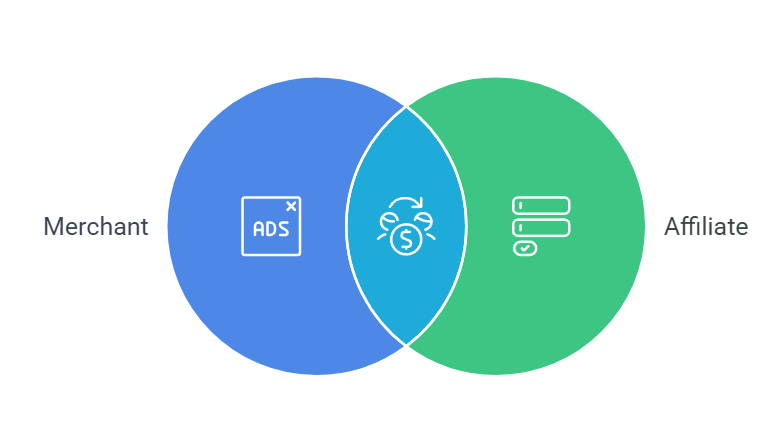

Affiliate marketing involves three key players: the merchant (or advertiser), the affiliate (or publisher), and the consumer.

The merchant creates a product or service and partners with affiliates who promote it. Affiliates earn a commission for each sale or lead generated through their marketing efforts, making it a win-win situation for both parties.

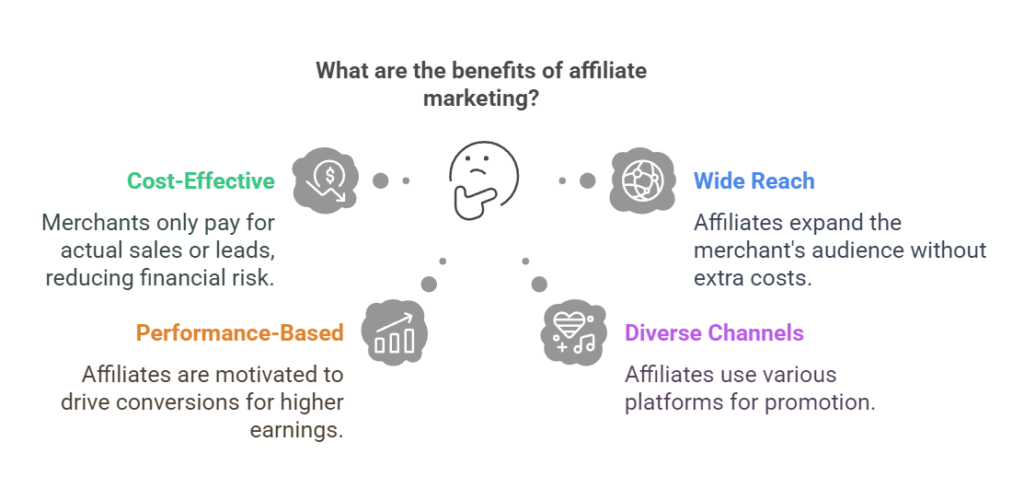

Benefits of Affiliate Marketing

- Cost-Effective: Merchants only pay for actual sales or leads, making it a low-risk marketing strategy.

- Wide Reach: Affiliates can tap into their own audiences, expanding the merchant’s reach without additional advertising costs.

- Performance-Based: Affiliates are motivated to perform well since their earnings depend on their success in driving conversions.

- Diverse Marketing Channels: Affiliates can utilize various platforms, including blogs, social media, and email marketing, to promote products.

Strategies for Success in Affiliate Marketing

- Choose the Right Niche: Focus on a niche that aligns with your interests and expertise to create authentic content that resonates with your audience.

- Build Trust with Your Audience: Establish credibility by providing valuable content and honest reviews. Trust is crucial for driving conversions.

- Leverage SEO: Optimize your content for search engines to increase visibility and attract organic traffic to your affiliate links.

- Utilize Social Media: Promote your affiliate products on social media platforms to reach a broader audience and engage with potential customers.

- Track Performance: Use analytics tools to monitor your campaigns, understand what works, and adjust your strategies accordingly.

Tips for Affiliates

- Select Quality Products: Promote products that you believe in and that offer real value to your audience.

- Diversify Your Income Streams: Don’t rely on a single affiliate program; explore multiple partnerships to mitigate risks.

- Stay Updated: Keep abreast of industry trends and changes in affiliate programs to stay competitive.

Tips for Merchants

- Choose Affiliates Wisely: Partner with affiliates who align with your brand values and have a genuine connection with their audience.

- Provide Resources: Equip your affiliates with marketing materials, product information, and support to help them succeed.

- Monitor and Optimize: Regularly review affiliate performance and provide feedback to help them improve their strategies.

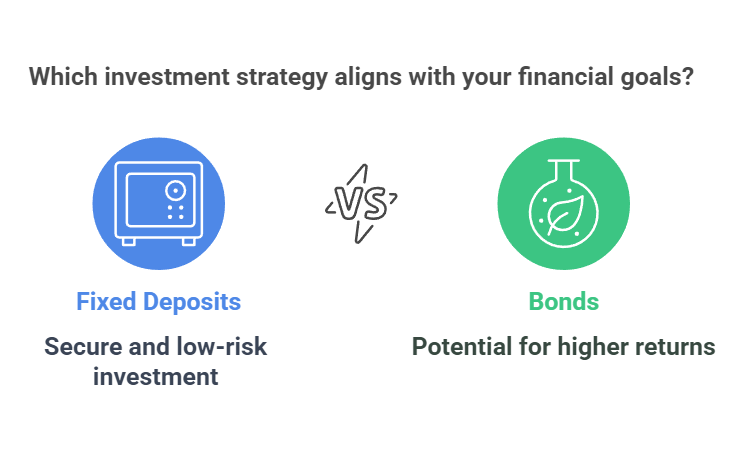

5.Invest in Fixed Deposits and Bonds

Investing in fixed deposits (FDs) and bonds is a prudent strategy for individuals seeking to secure their financial future while minimizing risk.

This document explores the benefits, features, and considerations of investing in these financial instruments, providing insights for both novice and seasoned investors.

Understanding Fixed Deposits

Fixed deposits are financial instruments offered by banks and financial institutions that allow individuals to deposit a lump sum amount for a fixed tenure at a predetermined interest rate. The key features of fixed deposits include:

- Safety: FDs are considered low-risk investments, as they are typically insured by government agencies up to a certain limit.

- Guaranteed Returns: Investors receive a fixed interest rate, ensuring predictable returns over the investment period.

- Flexibility: FDs come with various tenure options, ranging from a few months to several years, allowing investors to choose based on their financial goals.

Benefits of Fixed Deposits

- Capital Protection: The principal amount is safe and returns are guaranteed.

- Regular Income: Interest can be paid out monthly, quarterly, or at maturity, providing a steady income stream.

- Tax Benefits: Certain fixed deposits qualify for tax deductions under specific sections of the Income Tax Act.

Exploring Bonds

Bonds are debt securities issued by corporations, municipalities, or governments to raise capital. When you purchase a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Key features of bonds include:

- Variety: Bonds come in various forms, including government bonds, corporate bonds, and municipal bonds, each with different risk and return profiles.

- Interest Payments: Bonds typically pay interest semi-annually, providing regular income to investors.

- Liquidity: Many bonds can be traded in the secondary market, offering investors the ability to sell before maturity.

Benefits of Bonds

- Diversification: Bonds can help diversify an investment portfolio, reducing overall risk.

- Predictable Income: Fixed interest payments provide a reliable income source.

- Inflation Hedge: Certain bonds, like Treasury Inflation-Protected Securities (TIPS), offer protection against inflation.

Considerations Before Investing

While fixed deposits and bonds offer numerous advantages, investors should consider the following factors:

- Interest Rate Risk: Rising interest rates can lead to a decline in bond prices, affecting returns.

- Inflation Risk: Fixed returns may not keep pace with inflation, eroding purchasing power over time.

- Liquidity Needs: FDs typically have penalties for early withdrawal, while bonds may require careful timing for sale in the secondary market.

6. Peer-to-Peer (P2P) Lending

Peer-to-Peer (P2P) lending has emerged as a revolutionary financial model that connects borrowers directly with individual lenders through online platforms.

This document explores the fundamentals of P2P lending, its benefits and risks, the operational mechanisms, and its impact on the traditional banking system.

As an alternative to conventional lending, P2P lending offers unique opportunities for both borrowers seeking loans and investors looking for attractive returns.

What is P2P Lending?

P2P lending is a method of borrowing and lending money without the involvement of traditional financial institutions like banks.

Instead, online platforms facilitate the process, allowing individuals to lend money to others in exchange for interest payments.

Borrowers can access funds for various purposes, such as personal loans, business financing, or debt consolidation, while lenders can earn interest on their investments.

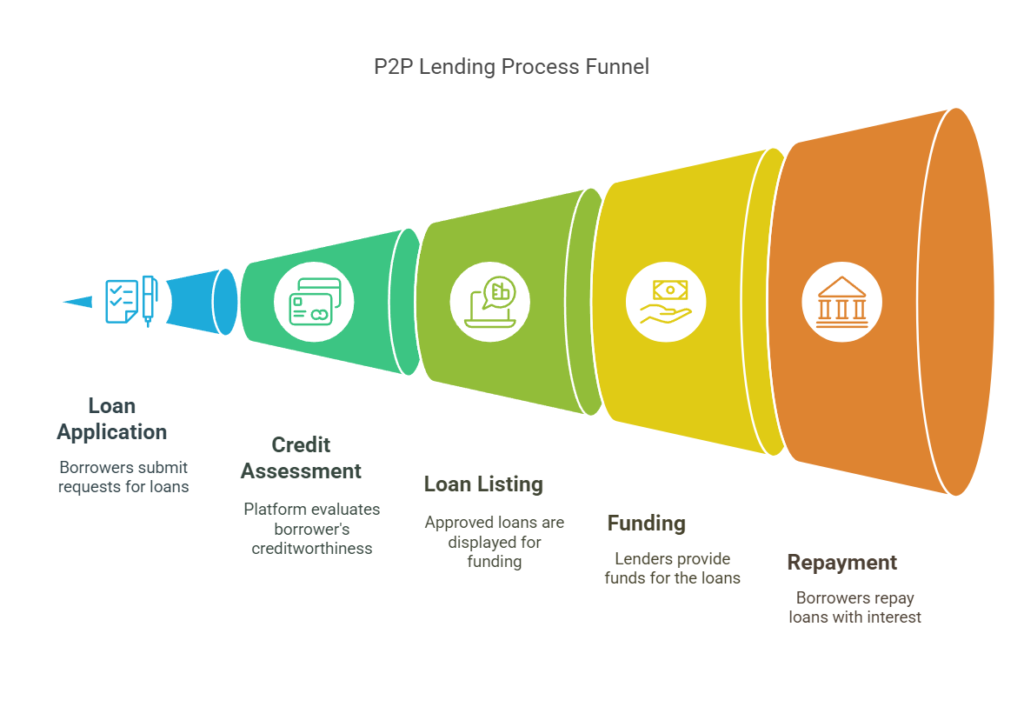

How P2P Lending Works

- Platform Registration: Both borrowers and lenders must register on a P2P lending platform.

- Loan Application: Borrowers submit loan requests detailing the amount needed and the purpose of the loan.

- Credit Assessment: The platform evaluates the borrower’s creditworthiness using various metrics, including credit scores and financial history.

- Listing Loans: Approved loans are listed on the platform, where lenders can review and choose which loans to fund.

- Funding: Lenders can fund a portion or the entirety of a loan. Once fully funded, the loan is disbursed to the borrower.

- Repayment: Borrowers repay the loan in installments, which include both principal and interest, back to the lenders through the platform.

Benefits of P2P Lending

- Lower Interest Rates: Borrowers often find lower interest rates compared to traditional banks due to reduced overhead costs for P2P platforms.

- Accessibility: P2P lending can provide access to funds for individuals who may have difficulty obtaining loans from banks due to strict lending criteria.

- Diversification for Investors: Lenders can diversify their investment portfolios by funding multiple loans across different borrowers and risk levels.

- Transparency: P2P platforms typically provide detailed information about borrowers, allowing lenders to make informed decisions.

Risks of P2P Lending

- Default Risk: There is a risk that borrowers may default on their loans, leading to potential losses for lenders.

- Platform Risk: The stability and reliability of the P2P platform itself can pose risks, including operational failures or insolvency.

- Regulatory Risk: P2P lending is subject to regulatory changes that could impact the operations of platforms and the rights of lenders and borrowers.

- Limited Liquidity: Unlike traditional investments, P2P loans are generally illiquid, meaning lenders may not be able to quickly access their funds.

FAQs on Earning Passive Income in India

1. What is the best way to earn passive income from home in India?

The best way depends on your interests and skills. Blogging, investing in stocks, and creating digital products are popular and scalable options.

2. Do I need a lot of money to start earning passive income?

Not necessarily. Many options, like blogging, affiliate marketing, and digital products, require minimal upfront investment.

3. How long does it take to start earning passive income?

It varies. Blogging and YouTube can take several months to generate income, while dividend stocks and rental properties may provide quicker returns.

4. Is passive income taxable in India?

Yes, passive income is taxable in India. The tax rate depends on the type of income, such as rent, dividends, or capital gains.

5. How can I manage risks when investing for passive income?

Diversify your investments and conduct thorough research before investing. Seek advice from financial experts if needed.

By exploring these proven strategies and implementing them wisely, you can build a sustainable passive income stream from the comfort of your home in India. Start today and take the first step toward financial independence!

One Comment